Rebuilding South African Airways through strategic partnerships and improved governance

- Sep 10, 2025

- 29 min read

Updated: Oct 13, 2025

Occasional Paper 9/2025

Copyright © 2025

Inclusive Society Institute

PO Box 12609, Mill Street

Cape Town, 8010

South Africa

235-515 NPO

All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without the permission in writing from the Inclusive Society Institute.

D I S C L A I M E R

Views expressed in this report do not necessarily represent the views of the Inclusive Society Institute or those of their respective Board or Council members.

SEPTEMBER 2025

Emil Gumede

Aviation Analyst based at the University of Sussex, United Kingdom

Abstract

South African Airways’ (SAA) audit results for 2023/24, despite being published 10 months late and uncovering an accounting error that flipped a profit to a loss, reflect encouraging signs of recovery from its previous position under business rescue. The airline is now debt-free and has been gradually expanding its fleet and routes. However, SAA still has many challenges to overcome. At the heart of these is failing governance. State ownership of the airline has been ineffective, as this model has run on political connectedness and government alliances, rather than competence and profitability. There are also global challenges including new aviation regulatory regimes, fluctuating fuel prices, and changing consumer preferences. And, worse, US President Trump’s exorbitant tariffs – which will likely hit Africa the hardest – will leave airlines vulnerable to even minor shifts in operating costs and supply chain disruptions.

This paper argues that SAA can not only be saved from potential disaster, but it can also be turned into a major contributor to South Africa’s GDP and employment sector. To do so, SAA must be depoliticised, ensure impeccable governance and service differentiation, target high-income routes and smart strategic partnerships, and pivot South Africa as a key international connecting hub. Many airlines have had success through partnerships, which can help leverage economies of scale by bulk buying aircraft and fuel together, sharing routes and services. SAA needs a new, more diverse share ownership model, which excludes the state from being the major owner, although still giving the state a part-ownership role. Cathay Pacific’s diverse mixed private-public-state shareholder ownership model, which drove its successful turnaround, could be a model for SAA.

Introduction

To ensure long-term success, South African Airways (SAA), in its rebuilding, needs to consider targeting new high-income routes currently under-serviced, securing strategic partnerships with other airlines, and pivoting South Africa as a key international connecting hub between continents.

Airlines that have successfully overcome the aviation COVID-19 pandemic-induced plunge in passenger traffic, revenue losses and closures, have done so in part by striking clever strategic partnerships, tie-ups, and mergers. South African Airways, and many domestic and African airlines, have struggled to overcome the COVID-19-induced challenges, while having to deal with an array of new ones, such as new aviation regulatory regimes, fluctuating fuel prices — worsened by the impact of Russia’s invasion of Ukraine and the Middle East conflict — and changing consumer preferences. Strategic partnerships emerge as pivotal mechanisms to bolster sustainability (de Vos, 2025). While many airlines have never recovered from COVID-19, others that struck partnerships to share capacity, costs, and risks, have often not only achieved full financial recovery but have also surpassed their pre-pandemic performance.

However, the sweeping tariffs introduced by US President Donald Trump will knock the global aviation industry, which was just recovering from the devastation of the global lockdowns because of COVID-19, with Africa likely to suffer the most. The sweeping US tariffs will significantly disrupt global trade, industry sectors — including aviation — and domestic economies, with major consequences everywhere. Africa is likely to be the region hardest hit. Some of Africa’s airlines may collapse.

From increased aircraft purchase and maintenance prices, as well as higher ticket prices, the effects of the tariffs will be felt across the global aviation industry. Airlines that are already operating on very thin margins will be forced to pass costs onto customers, ultimately making air travel less accessible (Chen, 2025). SAA has experienced a moderate yet steady recovery since resuming operations after the COVID-19 pandemic, slowly acquiring additional aircraft and reintroducing destinations it once served, but now faces the negative impact of the punishing tariffs introduced by the Trump administration.

A major COVID-19-related challenge for airlines has been a dearth of aircraft availability due to supply chain disruptions, which have undermined the sustainability of many airlines. For instance, the Lufthansa Group in 2023 reported a half-year loss of 427 million Euros, which the company largely attributed to aircraft delivery delays (IATA, 2025).

SAA has experienced a moderate yet steady recovery since resuming operations after the COVID-19 pandemic, slowly acquiring additional aircraft and reintroducing destinations it once served. Despite facing a few obstacles, such as the privatisation deal with Takatso Consortium disappointingly falling apart and the recent pilot strike causing significant delays and cancellations, which have since been resolved, SAA appears, in general, to be on the up. However, in July 2025, SAA published its audited financial results for the 2023/24 financial year 10 months late and revealed a loss of R354 million for the year. The 2023/24 financial year reflected the second full year of operations since the group got out of business rescue in April 2021 (Fraser, 2025).

Nevertheless, while SAA’s improvements are encouraging, further progress will require strategic planning, entrepreneurial foresight, and global partnerships and better governance.

US Tariffs will undermine global aviation

The sweeping US tariffs will significantly disrupt global trade, industry sectors — including aviation — and domestic economies, with major consequences everywhere. Africa is likely to be the region hardest hit. Some of Africa’s airlines may collapse (de Vos, 2025).

From increased aircraft purchase and maintenance prices, as well as higher ticket prices, the effects of the tariffs will be felt across the global aviation industry. Airlines already operating on very thin margins will be forced to pass costs onto customers, making air travel less accessible (Chen, 2025).

The International Air Transport Association (IATA) financial forecasts for the year 2025 — before the Trump tariffs — show the global net profit for the industry being $36.6 billion. Of that total, Africa is set to contribute a mere $0.2 billion. Airlines operate on extremely thin profit margins, just 3.6% globally, according to IATA (IATA, 2025). Worse, the African aviation industry profit margin forecast for 2025 was just 0.9% compared to the global 3.6% (IATA, 2025). This means airlines have little ability to absorb the additional costs that Trump’s global tariffs will bring. Airlines are likely to pass them on to passengers through higher ticket prices, added fees, or reduced services.

The overall impact on travellers could manifest in several ways. Domestic flights, particularly in the US, may see noticeable price increases, while international travel could become more expensive as well. Budget airlines, which rely heavily on cost efficiency, may be forced to raise baggage fees or introduce new surcharges to offset rising expenses. With profit margins already razor-thin, even small cost increases could significantly reshape airfare pricing, making travel less affordable for many passengers (IATA, 2025). The effects of the tariffs on different regions are likely to vary, with some regions being hit harder than others.

This narrow margin leaves African airlines highly vulnerable to even minor fluctuations in operating costs, which can prove disastrous for many of the continent’s carriers. Rising aircraft purchase prices, increasing maintenance fees, and fluctuating fuel costs will further strain the already fragile financial standing of African airlines. Trump’s tariffs against many African countries and the withdrawal of US development aid to African countries have already made many African economies even more fragile.

The aviation industry is built on a complex tapestry of globally interconnected nodes. Aircraft manufacturers and maintenance service providers rely on sourcing parts and materials from all around the world. Because of the global supply chain of the aviation industry, it is very susceptible to global economic disruptions, whether economic downturns, global economic crises, or pandemics such as COVID-19 (IATA, 2025).

This fine balance has and will continue to be affected by Donald Trump’s radical trade policies, which will have a heavy impact on many different segments of the industry, disrupt supply chains, increase the costs of supplies, and restrict global travel. From increased manufacturing costs for Boeing to potential price hikes on airline tickets, these tariffs have reshaped the economics of air travel (Chen, 2025). Ironically, the impact of Trump tariffs will also negatively impact the US domestic market (de Vos, 2025).

Production costs are increasing for both Boeing and Airbus, which together hold a 100% market share duopoly on widebody aircraft. Airlines will inevitably feel the impact. Another indirect effect is the potential delay in fleet modernisation. If airlines postpone purchasing newer, fuel-efficient planes due to higher costs, they may continue operating older aircraft that consume more fuel (Chen, 2025).

Trump’s tariff war has had significant consequences for Boeing and will continue to do so, as the 25% tariffs on all steel and aluminum imports will substantially increase production costs (Chen, 2025). Boeing depends heavily on a finely balanced global supply chain, with a vast range of international vendors and manufacturers. In total, more than 20 countries contribute to the production of the Boeing 737. Boeing’s CEO Kelly Ortberg shared his concerns in an address to company employees, saying it will be challenging to keep prices competitive due to inevitable supply chain disruptions (Hepher, 2025). Airbus CEO Guillaume Faury has also expressed concerns about what the tariffs could mean not just for Airbus but for the industry as a whole (Hepher, 2025).

Ireland’s AerCap, the world’s largest aviation leasing company — which boasts a portfolio of over 2,000 aircraft and helicopters with orders for nearly 400 additional aircraft (as of 14 March 2025) — has also expressed concerns about the effects of the tariffs. AerCap CEO Aengus Kelly stated that if the EU retaliates with tariffs of their own, Boeing products such as the hugely popular 787 Dreamliner could cost upwards of $40 million more (Chen, 2025).

Many African airlines, including SAA, lease their planes, which could now be more expensive to lease (Chen, 2025). As of June 2025, SAA has 18 aircraft, of which 16 are leased and two are owned. These aircraft are sourced from a range of companies; five have been leased from Ireland’s AerCap, two from Air Lease Corporation (USA), three from China Aircraft Leasing Company (CALC), four from SMBC Aviation Capital (Japan), two from CMB Financial Leasing (China), one from Airborne Capital (Ireland) and one from Aergo Capital (Ireland) (Planespotters.net, 2025). All the companies that SAA have sourced their aircraft from will inevitably face the challenges of increased aircraft acquisition and maintenance fees, which will ultimately be passed on to clients such as SAA. Even though SAA operates a fleet of aircraft exclusively made by Airbus, who are entirely European owned, key components that are built in the USA will drive up prices.

Strategic partnerships – global aviation learnings

North American, Latin American, European, Middle Eastern, and Asian airlines have increasingly formed strategic partnerships to enhance connectivity, optimise operations, and expand market presence. In the Middle East, Qatar Airways has implemented the partnership model with significant success. The benefits of these partnerships are most evident in economies of scale; for example, airlines can negotiate more favourable pricing when making bulk purchases for aircraft, fuel, maintenance, and other supplies.

The US aviation market, the largest globally, has witnessed numerous mergers throughout its history — often driven by necessity or competition. Recently, Alaska Airlines decided to merge with Hawaiian Airlines to strengthen its position in aviation markets between Hawaii, the mainland US, and the Asia-Pacific region (US Department of Transportation, 2025). By combining resources, the two carriers aim to expand their networks and consumer offerings while competing with the American "big three": American Airlines, Delta, and United. This merger reflects the increasing reliance on partnerships to navigate a volatile industry.

In Europe’s highly competitive aviation landscape, strategic partnerships have also proven essential. The International Airlines Group (IAG), formed by the British-Spanish merger between British Airways and Iberia, now includes LEVEL, a low-cost airline brand, and the IAG rewards programme. In 2013, IAG made headlines with one of the largest orders for Airbus A320neo aircraft, buying 220 units. With a list price of approximately $110 million per aircraft, IAG’s large-scale order enabled it to secure an estimated 15% discount, reducing the cost per aircraft to around $93.5 million and saving the group approximately $3.6 billion (BBC News, 2013). These aircraft were then strategically allocated across IAG’s member airlines.

The Middle East has become pivotal to global aviation due to its strategic geographic location, fostering the rise of global carriers such as Qatar Airways. Despite facing challenges similar to those of other carriers — such as fluctuating fuel prices and financial constraints — Qatar Airways has effectively leveraged strategic partnerships to remain resilient. The COVID-19 pandemic exacerbated aircraft supply shortages due to supply chain disruptions, threatening the sustainability of many carriers. For instance, the Lufthansa Group reported a half-year loss of €427 million in 2023, attributing much of this to aircraft delivery delays (Lufthansa Group, 2024).

As a member of the Oneworld Alliance, which includes Finnair, Royal Air Maroc, and Qantas, Qatar Airways has used these alliances to mitigate such disruptions by sharing routes and costs. A notable example includes Finnair's shift in strategy due to the closure of Russian airspace. As a result, it partnered with Qatar Airways to operate direct flights from Scandinavian capitals to Doha. This collaboration was critical, given Finland’s proximity to Russia, which is engaged in a conflict with Ukraine. Similarly, Qatar Airways partnered with British Airways to operate flights between London Heathrow/Gatwick and Doha. American Airlines also partnered with Qatar Airways for its new service between New York JFK and Doha. In these alliances, partner airlines use their own aircraft while maintaining cooperative route operations with Qatar Airways.

African airlines have struggled to build strategic alliances

Difficult domestic and global economic environments pose significant hurdles for African airlines and SAA. Fluctuating currencies, limited access to financing, and high operating costs have cast a long shadow over the financial viability of many African airlines. Partnerships can range from joint ventures, mergers, and route sharing.

African partnerships could also improve service offerings, improve quality, streamline flight schedules, and foster economic growth within the region. Together, successful African aviation collaborations could modernise Africa’s aviation industry, reduce costs, expand the aviation sector considerably, and can help African airlines compete more effectively in the global market. Partnerships can help African airlines leverage economies of scale by bulk buying aircraft together, sharing routes and services. Forming strategic alliances can enhance market reach, boost operational efficiency, share costs, and improve services.

However, many African attempts to build partnerships have, sadly, failed. Ethiopian Airlines stands out as the most successful airline on the African continent. Ethiopian Airlines has also formed strategic partnerships and alliances, expanding its reach and enhancing its competitiveness. The airline has consistently had professional management, regularly benchmarked its performance against global competitors, and has prioritised profitability. Ethiopian Airlines rightly proposed a joint venture with the Nigerian government to operate a new proposed Nigerian airline, in which Ethiopian Airlines would own 49%. Although Ethiopian Airlines sank considerable investment in the proposed joint venture, it fell apart, because of local Nigerian opposition to foreign ownership.

The Nigerian government-Ethiopian Airlines collaboration could have modernised Nigeria's aged aviation sector by integrating it into Ethiopian Airlines' global network and operational expertise. This would have improved connectivity, service quality, and operational efficiency, potentially reducing costs and enhancing competitiveness for Nigerian airlines.

Kenya Airways proposed, in 2021, a Pan African strategic partnership with South African Airways. However, it never gained traction, mainly because of SAA’s governance, operational, and direction struggles. Similarly, the South African Airways-Kenya Airways partnership, if pulled off, could expand route networks and enhance connectivity across Africa and internationally for both airlines (Pande, 2022).

In 2024, two major West African airlines sealed a strategic alliance. Air Sénégal and Air Côte d’Ivoire struck a strategic commercial and operational partnership with the intention of “pooling their networks, offering passengers enhanced connections while optimising both airlines’ operating costs” (Deenapanray, 2024). Through the partnership, both sets of customers will get access to more destinations, more connections, and more frequent flights, domestically, regionally, and internationally. The partnership linked the airlines’ loyalty programmes. As part of the agreement, the airlines pool their technical teams, human resources personnel, and logistics. The airlines would buy fuel jointly. The airlines would also share maintenance, repair, and overhaul capacity (Deenapanray, 2024).

Figure 1: African Airline Failures - Reasons

African airlines have battled with governance

Many of Africa’s failing airlines are state-owned — appointments and contracts are made by governing parties and leaders, based on connectedness not on competence and ability, which means their management is often poor. Governments that own African airlines often do not insist that they make profits or are managed efficiently. Airlines are often viewed solely as state utilities that can provide jobs, contracts for members of the governing elite, and prestige for African governing parties. Airlines are often run on unprofitable routes, but which satisfy political alliances and considerations their governments have with other countries.

Failing state airlines are often fiercely protected — for prestige and patronage reasons, even if they are inefficient, run corruptly, and are wasteful. Many state airlines are regularly bailed out by governments, without the requirement that they in turn be managed by competent managers, they increase performance and cut waste. For instance, Kenya Airways recently received a R5.85 billion ($300 million) state bailout, which, according to Business Insider Africa, takes the airline's total liabilities to R16.5 billion ($845.5 million) (Benson, 2022).

In 2023, Air Mauritius CEO Krešimir Kučko and CFO Jean Laval Ah Chip were forced to temporarily stand by the airline’s board after it was alleged that the duo accepted a stay in a hotel in France, covered by one of Air Mauritius’ suppliers (Airspace Africa, 2023). Air Mauritius is one of the better-run African airlines.

Nigeria’s Senate Committee on Aviation, in 2023, slammed the launch of Nigeria’s then new carrier Nigeria Air as a ‘fraud’ during an investigative hearing with Airline Operators of Nigeria (AON) and representatives of the ministry of aviation (Kedem, 2023). During the hearing, former Minister of Aviation Hadi Sirika claimed that Nigeria Air was only unveiled and not launched during a fanfare on 26 May 2023. At the unveiling of the aircraft, Sirika said the airline was expected to commence operations in a month’s time. The aircraft used for the unveiling was discovered to be a chartered flight (Kedem, 2023).

While numerous airlines have faced challenges, and even failures, across Africa, there are shining examples of success that demonstrate the potential for growth and profitability when African airlines improved their governance. Ethiopian Airlines stands out as the most successful airline on the African continent. Ethiopian Airlines has consistently had professional management, regularly benchmarked its performance against global competitors, and has prioritised profitability. The Ethiopian government has stayed clear of meddling in its operations.

TAAG Angola Airlines, the national carrier of Angola, has proven to be another African success story; the airline has witnessed an impressive recovery in the post-pandemic era. In fiscal year 2022, the airline achieved significant financial success, with a remarkable 30% increase in net profit, totaling R15.4 million ($800 000). Operating revenue also doubled compared to the previous year, reaching R7.5 billion ($390 million). Notably, TAAG's cargo operations experienced strong growth, contributing R1.2 billion ($67 million) in operating revenue (Casinader, 2023)

The Angolan government appointed Eduardo Fairen Soria, an experienced manager, engineer and pilot, and former CEO of VIVA Air Peru, as the CEO of TAAG. Soria has prioritised professionalising the operations of TAAG Air, benchmarking its operations against those of successful international peers, and focusing on making the airline profitable. He has focused on niche markets. The Angolan government plans to privatise the airline.

SAA has shown steady improvement since its return following business rescue

SAA’s proposed privatisation equity deal with the Takatso Consortium, which would have seen a 51% stake taken over by private investors, collapsed in March 2024. SAA has been beset by mismanagement, corruption allegations, and loss-making (Auditor-General, 2024; BusinessTech, 2025; Creecy, 2025). Between 2007 and 2022, it received bailouts of over R50 billion from government. The company has battled with managing its finances since 2018, with its 2019-2022 financial audits only recently being completed.

In July 2025, SAA published its financial results 10 months late. It reported that a R431 million accounting error has wiped out its previously published profit for the 2023/24 financial year. The accounting error caused a loss of R354 million, a reversal of the previously reported profit of R60 million (SAA, 2025). Transport Minister Barbara Creecy (Airspace Africa, 2025) said: “The error is regrettable, but it does not negate the operational efficiencies achieved.”

On the upside, SAA generated revenue of R7 billion, which showed a 23% year-on-year increase for the company. It said currency fluctuations and ‘external’ factors impacted its operations. SAA reported a R415 million foreign-currency translation loss because of the rand’s volatility.

A negative trading environment undermined the company. Higher fuel prices also impacted on the company’s profit margins. Russia’s invasion of Ukraine pushed SAA’s jet fuel costs from R1.3 billion to R1.9 billion during the period. SAA’s finances were also undermined by the global shortage of aircraft, which caused a delay in SAA receiving ordered aircraft. But it also hiked SAA’s aircraft leasing costs by more than 30%. All of which reduced the company’s revenue.

On a positive note, SAA reported healthy cash and cash equivalents of R1.4 billion, and R6.4 billion in equity. SAA’s revenue rose 183% to R5.7 billion in 2022/23. And has no borrowings, as it has now eliminated its past obligations. However, without an equity partner, SAA is systemically vulnerable to any financial volatility.

SAA’s number of flights increased by 42%. Since September 2021, since it restarted its operations following business rescue, SAA has increased its networks to 16 routes and doubled its aircraft fleet to 18. It also plans to increase its fleet by 30% and double its route network within 18 months. Mango Airlines, the wholly owned subsidiary of SAA, is undergoing business rescue. Mango was placed in voluntary business rescue on 28 July 2021. It has struggled to secure an investor (BusinessTech, 2025). Furthermore, the business rescue has received a blow after one of its creditors got a court ruling declaring the business rescue invalid.

Transport Minister Barbara Creecy (2025) in her Budget Vote Speech said: “Now operating independently and no longer reliant on government guarantees, SAA is self-funding its operations and fleet growth, while remaining open to a strategic equity partner as part of its long-term restructuring.”

SAA’s Chief Executive John Lamola said: “… we have entered a period of structured and strategic reconstruction of the business, focusing on institutionalising robust governance and management systems, whilst implementing plans on aircraft fleet and route network expansion and elevation of customer experience.” Lamola added: “The FY2023/24 results reflect significant progress in SAA’s financial health. We have strengthened the channels of our revenue streams and cost containment measures. We have a debt-free, asset-rich balance sheet that is supporting the steady growth of the airline and the recovery of SAA as a global aviation brand.”

According to a 2024 report by Oxford Economics, commissioned by SAA, the airline contributed R9.1 billion to South Africa’s GDP in 2023/24. SAA’s contribution is projected to more than triple to R32.6 billion by 2029/30. Over the same period, the airline's operations are expected to support 86,700 jobs, an increase from the current 25,000 (Oxford Economics, 2024).

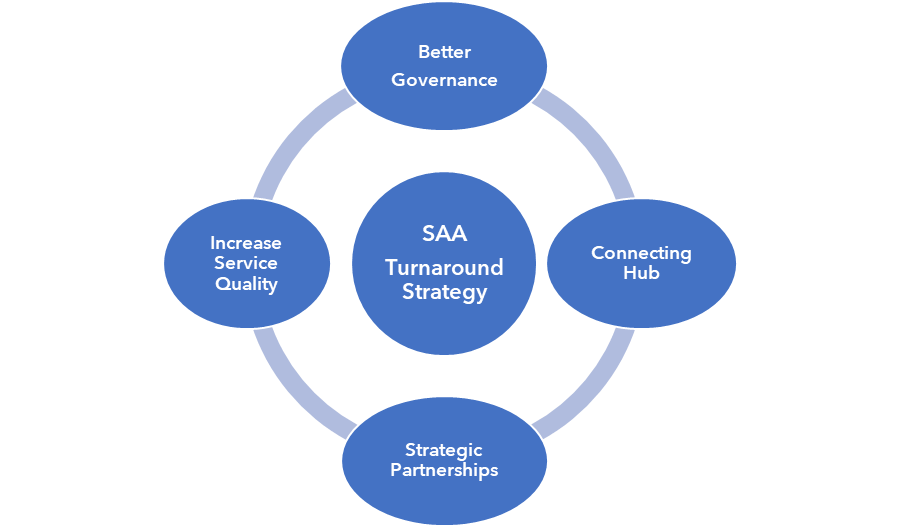

Figure 2: Proposed SAA Turnaround Strategy Pillars

How SAA can strike strategic partnerships

To ensure long-term success, South African Airways need to consider targeting potential new high-income routes currently under-serviced, strategic partnerships with other airlines, and pivoting South Africa as a key international connecting hub between continents.

Pursuing a connecting hub strategy will make it easier for SAA to attract strategic partners who could co-share service offerings and products, leveraging economies of scale by bulk buying aircraft or fuel, which would reduce costs. It will also improve services, enhance market share, and boost operational efficiencies. Such a strategy would increase flight footprints. Increasing flights will mean cheaper airfares. Overall, a connecting hub strategy would increase the competitiveness of not only SAA, but South Africa, as it would bring more people, business, and capital to the country.

Restarting a direct flight between Johannesburg and Mumbai seems like an obvious strategic move. In 2019, over 3,000 passengers travelled between the two cities each month in both directions, totaling over 100,000 in the year. Due to SAA’s endemic past struggles, nearly 50% fly the India-South African route via Addis Ababa with Ethiopian Airlines — Johannesburg to Mumbai via Addis Ababa has become Ethiopian Airlines’ biggest airport pairing (Pearson, 2024).

This highlights a clear demand for a nonstop connection. A recent study by Airbus suggests that a direct flight between Johannesburg and Mumbai would significantly increase passenger numbers between Johannesburg and Mumbai. The convenience of nonstop travel would not only benefit business travellers and tourists but also South Africa's significant Indian diaspora. Furthermore, direct flights to Mumbai could open smoother connections to other major Indian cities such as Delhi and Bengaluru. This would offer SAA a valuable opportunity to tap into an underserved market. This enhanced connectivity would strengthen both economic, business, and cultural ties between the two regions.

South Africa is geographically situated between both Asia and Latin America. This offers an opportunity for SAA — to serve as a bridge, offering efficient transit options for passengers traveling to and between these two regions. SAA is particularly well-placed to be a link between Brazil and China via South Africa. As two prominent members of the BRICS trade alliance, China and Brazil are actively taking steps to boost economic collaboration.

Many global airlines leverage their geographic advantages to facilitate travel between Asia and the Americas. Leading carriers such as Qatar Airways, Ethiopian Airlines, Turkish Airlines, and Emirates have positioned themselves as key transit hubs connecting these regions. However, there is a surprising lack of direct air connectivity between China and Latin/South America, with only one direct route currently linking China to Mexico City.

China and Brazil have strengthened their bilateral ties, including signing a mutual visa agreement. This agreement allows ordinary passport holders from both nations to obtain visas valid for up to 10 years for purposes such as tourism, business, and family visits. Visa holders can stay for up to 90 days per visit, with the option to extend their stay to 180 days if necessary.

There is great potential for SAA to expand its connecting role by linking Latin America, Asia, and Australia, through a South African transport hub. These routes are strategically important for the airline as they benefit from strong point-to-point demand, ensuring consistent passenger traffic. Furthermore, these routes position SAA to serve as a key connector for passengers traveling between Latin America, Australia, and other destinations via its Johannesburg hub. Over and above business and tourism travel, with over 200,000 Latin American-born people living in Australia and a growing number of Australians with ethnic or cultural ties to Latin America, there is an increasing demand for connectivity between these regions. SAA, as of writing, operates direct flights to both São Paulo, Brazil, and Perth, Australia.

LATAM Airlines, the largest airline holding company in South Africa, after LAN Airlines of Chile took over TAM Linhas Aéreas of Brazil in 2012. LATAM Airlines expects to transport over 200,000 passengers annually on routes connecting Australia and Latin America (Aviaconline, 2025). This is also a potential opportunity for SAA to explore partnership with LATAM Airlines, now the largest airline company in Latin America.

SAA is desperate for a capital injection. SAA has for example been outspoken about its struggles to acquire additional aircraft since its return to the skies — because of lack of capital.

A strategic partnership with a capital-rich airline group is one option to secure new capital. In Africa, a strategic partnership between SAA and Ethiopian Airlines, modeled after Qatar Airways’ arrangement with IAG (International Airlines Group), could offer significant financial, operational, and strategic benefits. An SAA-Ethiopian Airlines partnership has been talked about for many years now, but has never been realised. The Qatar Airways-International Airlines Group partnership offers an example of what an SAA-Ethiopian Airlines or an SAA strategic partnership with a Latin American, Asian, Middle Eastern, or European airline group could look like.

Qatar Airways first acquired a 9.99% stake in IAG in 2015, gradually increasing it to 25.1% by 2020 with a $600 million investment. In 2024, IAG announced a €350 million share buyback, and Qatar participated by selling €88 million-worth of shares (Curren, 2024). Despite this sale, Qatar maintained its 25% stake due to the reduced number of shares in circulation after the buyback. Through this move, Qatar Airways can maintain its influence within IAG, while at the same time providing liquidity to IAG.

Ethiopian Airlines could for example provide SAA with a much-needed capital injection, either through acquiring an equity stake or participating in a share buyback programme if one were initiated. This would immediately strengthen SAA's financial position.

SAA needs to fix its governance

Failing governance has been at the heart of many of SAA’s problems. In March 2025, the Special Investigating Unit (SIU) announced it had formally added SAA to a list of state institutions to be investigated on allegations of "serious maladministration, corruption, and unlawful conduct".

In 2021, the SIU also probed 84 SAA contracts and 44 of its aircraft leases, following allegations of contractual irregularities such as inflated pricing, fronting, conflicts of interest on the part of SAA staff, ghost vendors, work orders, and bank accounts and over-payments. It also probed non-delivery of services and products (SCOPA, 2021). In 2015, the late SAA Chairwoman Dudu Myeni was alleged to have tried to recruit a third-party leasing company in the SAA’s 2015 contract with Airbus (Finance Standing Committee, 2016). The arrangement was stopped by then Finance Minister Nhlanhla Nene. The allegations were examined by the Zondo Commission on State Capture (Corruption Watch, 2022).

In March 2024, Parliament’s Public Enterprises Portfolio Committee had asked the SIU to investigate the now aborted sale of 51% of SAA to the Takatso Consortium. Former Public Enterprises Department Director-General Kgathatso Tlhakudi’s alleged misconduct in the Takatso deal suggested that SAA’s valuation for the transaction was inaccurate and that the Takatso Consortium was favoured (Thorne, 2024). The allegations of wrongdoing had been rejected by the late then Public Enterprises Minister Pravin Gordhan.

In September 2024, the Auditor-General told SAA to work on its governance structures to stabilise operations. Briefing the Standing Committee on Public Accounts (SCOPA) in Parliament in September 2024 about SAA’s audit outcomes for the 2018/19, 2019/20, 2020/21, and 2021/22 financial years, a team from the Auditor-General’s office recommended that executive leadership positions be filled with skilled and experienced personnel (Auditor-General, 2024). It said internal governance issues should be improved. It recommended that the key policies, procedures, and processes that underpin financial and record-keeping functions must be updated, implemented, and established where they did not exist. “The board and management must ensure that strict consequence management practices are ingrained in the culture of SAA. Officials who transgress or permit non-compliance must be held accountable for their actions.”

Poor governance led to SAA being placed under business rescue on 5 December 2019. Poor governance was at the heart of the operational deficiencies, a financial crisis, and the withdrawal of services by critical service providers. Irregular expenditure between 2018 and 2022 was R44.5 billion. Fruitless and wasteful expenditure increased over the same four periods and was R207.3 million. SAA received audit disclaimers from the Auditor-General from 2018/19 to 2021/22 and received R48.3 billion in government bailouts between the 2017/18 to 2022/23 financial years.

Lack of competent management, political interference in operations, appointments and contracts, and procurement corruption have been among the reasons the organisation has struggled. It appears that poor governance remains an issue at SAA.

In February 2025, the South African Cabinet approved the appointment of John Lamola’s permanent group chief executive officer for a two-year term. However, the decision has sparked controversy, with the Democratic Alliance (DA) filing a complaint with the Public Protector against Deputy President Paul Mashatile and Transport Minister Barbara Creecy for alleged undue political interference in the selection process (Sibiya & Cowan, 2025).

The SAA board initially recommended Allan Kilavuka, the current CEO of Kenya Airways, as the preferred candidate. Philip Saunders was also recommended as an option by the SAA board, who ranked Saunders higher than Lamola. Saunders was appointed SAA’s chief commercial officer in 2019 and briefly became the airline’s interim CEO in 2020. SAA will have to be run, not like a failing state-owned entity, with political management and board appointees, and needing state bailouts year after year, but as a profitable commercial company, run by experienced, merit-based management and board.

It is critical that SAA fixes its failing governance.

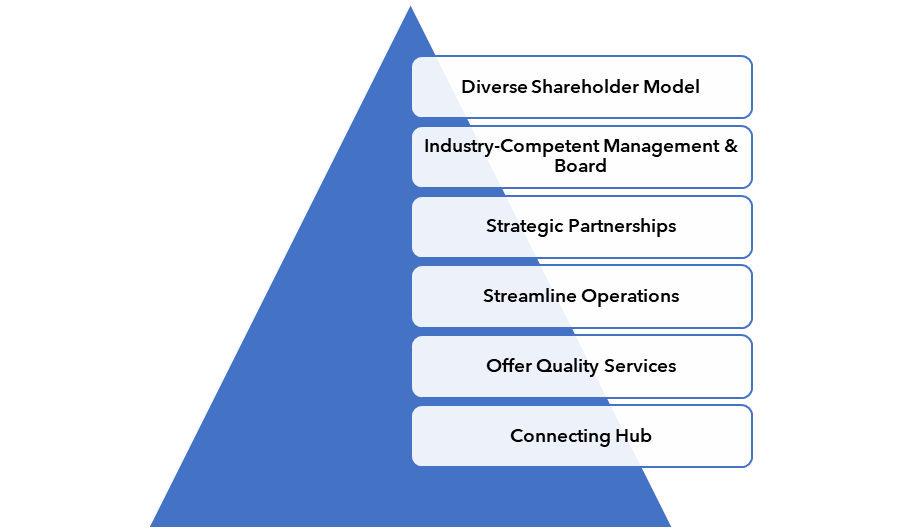

Figure 3: Cathay Pacific Turnaround Model

Cathay Pacific as a model for a revitalised SAA

The successful turnaround of Cathay Pacific, the flag carrier of Hong Kong, after the airline plunged into crisis because of COVID-19 lockdowns, through smart strategic partnerships, a new aviation industry-experienced management and board, impeccable governance, improved efficiency, and customer-friendly service, offers a turnaround path for South African Airways.

As SAA struggles with finding an equity partner and state ownership of the airline having been ineffective, the airline needs a new, more diverse share ownership model, which excludes the state from being the major owner, although still giving the state a part-ownership role.

Cathay Pacific’s diverse mixed private-public-state shareholder ownership model, which drove its successful turnaround, could be a model for SAA.

As of March 2024, Cathay Pacific operates as a publicly listed company, with Swire Pacific, a private company, being the largest shareholder. Air China owns the second-largest shareholding, and Qatar Airways the third-largest stake. The majority of Air China is owned by the state-owned China National Aviation Holding. This diverse shareholding structure of private, public and state-owned enterprise ownership should be looked at as an option for SAA.

Cathay Pacific was plunged into a devastating crisis following the COVID-19 lockdowns. The Hong Kong government, in 2020, then agreed to lead a $5 billion bailout of Cathay Pacific, taking a minority stake in the carrier. Cathay and parent company Swire Pacific had sought to raise $5 billion in new capital to help the airline survive the COVID-19 crisis. The Hong Kong government provided the bulk of the new funds by giving a $3.5 billion bailout package, consisting of loans and preferred share purchases. The remaining capital came from issuing new stock. Under the bailout deal, Aviation 2020, a limited company owned by Hong Kong’s government, took a 6% share in Cathay. The government would appoint two observers to Cathay’s board. By July 2024, Cathay had bought back the remaining half of the preference shares issued to the government as part of the COVID-19 bailout package during its airline’s recapitalisation in 2020.

SAA could do well by securing a cash-rich international airline partner, like a Qatar Airways, combined with a domestic private sector partner, and the remainder of the shareholding could remain with the state, preferably owned or managed by a specialist state entity like, for example, the Public Investment Company, rather than a government department as is currently the case.

Cathay Pacific’s post-pandemic turnaround strategy is also instructive to SAA. Cathay Pacific brutally cut areas of the company that were non-essential. The airline closed down Cathay Dragon, the regional arm of the airline (equivalent to state-owned SA Express) in order to streamline their operations. The 35-year-old Cathay Dragon had tanked during the COVID-19 lockdown crisis. To bring down costs and increase efficiency, the airline used the pandemic to get rid of all their older aircraft such as the expensive-to-operate Airbus a340, which SAA continues to use. Furthermore, as part of its post-COVID-19 turnaround strategy, the organisation right-sized its staff numbers, and reduced the pay of remaining staff.

Cathay Pacific has tightened up its governance. Appointments and contracts are made based largely on merit. The company has focused on making decisions, whether about routes or vendors, based on maximising its commercial profitability, rather than on political considerations.

The airline has a management team of incredibly talented, industry-proven, and widely respected individuals in the global aviation industry. Again, SAA could take a leaf out of Cathay’s book.

In late 2022, Cathay Pacific appointed an experienced top management and board to steer the turnaround. Ronald Lam, Cathay Pacific’s CEO since 2023, has been with the airline since 1996. He has extensive experience in commercial, cargo, and customer operations, having also run the low-cost carrier HK Express. Patrick Healy, Executive Chairman since 2019, has over 30 years’ experience with Swire Group. He held leadership roles across aviation and consumer businesses, including CEO of HAECO Xiamen and Managing Director at Swire Coca-Cola HK (Cathay Pacific, 2019).

Cathay Pacific pivoted its strategy on operating as an international aviation connecting hub. It has capitalised on Hong Kong’s position by building a strong network across Asia, connecting key regional markets to global destinations. Its central location enables efficient east-west and north-south connectivity, essential for both business and leisure travel. SAA has huge potential to operate in a similar way connecting East to West. There is a huge market to connect Asia and South America, Africa and Australia/Asia as well as Europe and Australia.

In a highly competitive aviation market, Cathay Pacific has focused on delivering world-class, superior, efficient, clean, and friendly services as a differentiator. In 2024, it was named in the Skytrax World Airline Awards, the fifth World’s Best Airline, the World’s Best Economy Class airline, and the World’s Cleanest airline. A revitalised SAA can also, like Cathay Pacific, prioritise delivery efficiency, and superior, clean, customer-friendly services. To do so, it must be depoliticised, appoint management and boards based on merit, ensure impeccable governance, and make smart strategic partnerships.

Conclusion

Clearly, SAA stands at a critical juncture, with encouraging signs of recovery marked by improved finances and the gradual expansion of its fleet and routes. However, sustaining this momentum requires strategic foresight, new capital and partnerships.

Many airlines, including African ones, such as Ethiopian Airlines, have achieved remarkable success through effective management, service differentiation, strategic alliances, government easing onerous administrative burdens, and through accountable governance. By strengthening its governance, ensuring competent management and board, and competent procurement, SAA can turn around. Political interference in operations, appointments, and contracts, and procurement corruption must be eliminated.

Through effective management, service differentiation, and strategic alliances, SAA can chart a path to prosperity. Reintroducing key routes, such as the Johannesburg-Mumbai connection, leveraging Johannesburg as a strategic transit hub between Latin America, Asia, and Australia, and exploring financial partnerships with established carriers are essential steps. By capitalising on these opportunities, SAA can strengthen its competitive edge, drive sustainable growth, and reaffirm its position as a leading African carrier on the global stage.

References

Airspace Africa. 2023. Air Mauritius CEO and CFO Suspended Amidst Corruption Probe and Expanding Horizons. [Online] Available at: https://airspace-africa.com/2023/09/21/air-mauritius-ceo-and-cfo-suspended-amidst-corruption-probe-and-expanding-horizons/ [accessed: 27 August 2025].

Airspace Africa. 2025. South African Airways’ Profit Plummets After R431 Million Accounting Error. [Online] Available at: https://airspace-africa.com/2025/07/18/south-african-airways-profit-plummets-after-r431-million-accounting-error/ [accessed: 27 August 2025].

Auditor-General. 2024. Briefing on SAA’s audit outcomes for the 2018/19, 2019/20, 2020/21 and 2021/22 financial years. Standing Committee on Public Accounts.

BBC News. 2013. International Airlines Group orders 220 Airbus A320 aircraft. [Online] Available at: https://www.bbc.co.uk/news/business-23706878 [accessed: 27 August 2025].

Benson, E.A. 2022. Kenya Airways’ total current liabilities now at $845.5 million. [Online] Available at: https://africa.businessinsider.com/local/markets/kenya-airways-total-current-liabilities-now-at-dollar8455-million/bjggd59 [accessed: 27 August 2025].

BusinessTech. 2025. Prominent South African airline in business rescue debacle. [Online] Available at: https://businesstech.co.za/news/business/831279/prominent-south-african-airline-in-business-rescue-debacle/ [accessed: 27 August 2025].

Casinader, T.C. 2023. TAAG Angola Airlines Reports Full-Year Profit For 2022. [Online] Available at: https://simpleflying.com/taag-angola-airlines-2022-full-year-profit/ [accessed: 27 August 2025].

Cathay Pacific Airways. 2025. Management Team. [Online] Available at: https://www.cathaypacific.com/cx/en_US/about-us/about-our-airline/management-team.html [accessed: 27 August 2025].

Chen, M.P.-C. 2025. Aircraft leasing executive says tariffs could cause Boeing’s prices to increase by $40 million. [Online] Available at: https://simpleflying.com/aircraft-leasing-executive-says-tariffs-could-cause-boeings-prices-to-increase-by-40-million/ [accessed: 27 August 2025].

Corruption Watch. 2022. Zondo report – SAA under Dudu Myeni was “the antithesis of accountability‘‘. [Online] Available at: https://www.corruptionwatch.org.za/zondo-report-saa-under-dudu-myeni-was-the-antithesis-of-accountability/ [accessed: 27 August 2025].

Creecy, B. 2025. Department of Transport Budget Vote Speech. [Online] Available at: https://www.transport.gov.za/wp-content/uploads/2023/02/Budget-SPEECH-2025-BY-THE-MINISTER-OF-TRANSPORT-FINAL-embargoed-1.pdf [accessed: 27 August 2025].

Deenapanray, A. 2024. West African airlines seal strategic alliance. [Online] Available at: https://www.timesaerospace.aero/features/air-transport/west-african-airlines-seal-strategic-alliance [accessed: 27 August 2025].

de Vos, S. 2025. Tariff wars are shaking the aviation industry and rippling down to Africa. [Online] Available at: https://africanpilot.africa/tariff-wars-are-shaking-the-aviation-industry-and-rippling-down-to-africa/ [accessed: 27 August 2025].

Ebrahim, N. 2025. SAA profit dives after R431m accounting error. [Online] Available at: https://www.news24.com/business/companies/saa-profit-dives-after-r431m-accounting-error-20250717-0949 [accessed: 27 August 2025].

Finance Standing Committee. 2016. Annual Reports 2015/2016. [Online] Available at: https://pmg.org.za/committee-meeting/23681/ [accessed: 27 August 2025].

Fraser, L. 2025. Major loss for SAA. [Online] Available at: https://businesstech.co.za/news/business/831984/major-loss-for-saa/ [accessed: 27 August 2025].

Freed, J. 2022. Cathay Pacific's new chief Lam to spearhead COVID recovery, two-brand plan. [Online] Available at: https://www.reuters.com/business/aerospace-defense/cathay-pacific-appoints-long-serving-executive-ronald-lam-next-ceo-2022-11-09/ [accessed: 27 August 2025].

Hepher, T. 2025. Airbus studying evolving tariff situation, CEO says. [Online] Available at: https://www.reuters.com/business/aerospace-defense/airbus-studying-evolving-tariff-situation-ceo-says-2025-04-15/ [accessed: 27 August 2025].

International Air Transport Association (IATA). 2025. Global outlook for air transport: June 2025. [Online] Available at: https://www.iata.org/en/iata-repository/publications/economic-reports/global-outlook-for-air-transport-june-2025/ [accessed: 27 August 2025].

Kedem, S. 2023. Nigeria Air launch denounced as “fraud”. [Online] Available at: https://african.business/2023/06/quick-reads/nigeria-air-launch-denounced-as-fraud [accessed: 27 August 2025].

Lee, D. 2020. Cathay Dragon’s 35-year run comes to an end as coronavirus claims one more victim. [Online] Available at: https://www.scmp.com/news/hong-kong/transport/article/3106529/cathay-dragons-35-year-run-comes-end-coronavirus-claims [accessed: 27 August 2025].

Lufthansa Group. 2024. Lufthansa Group adjusts full-year guidance. [Online] Available at: https://newsroom.lufthansagroup.com/en/lufthansa-group-adjusts-full-year-guidance/ [accessed: 27 August 2025].

Mkentane, L. 2024. Auditor-general urges SAA to work on governance structures. [Online] Available at: https://www.businesslive.co.za/bd/national/2024-09-17-auditor-general-urges-saa-to-work-on-governance-structures/ [accessed: 27 August 2025].

Oxford Economics. 2024. The future economic impact of South African Airways. [Online] Available at: https://www.oxfordeconomics.com/resource/the-future-economic-impact-of-south-african-airways/ [accessed: 27 August 2025].

Pande, P. 2022. What We Know So Far About South African Airways & Kenya Airways' Alliance. [Online] Available at: https://simpleflying.com/saa-kenya-airways-alliance/ [accessed: 27 August 2025].

Pham, S. 2020. Hong Kong takes stake in Cathay Pacific as part of $5 billion bailout. [Online] Available at: https://edition.cnn.com/2020/06/09/business/cathay-pacific-hong-kong-bailout-intl-hnk [accessed: 27 August 2025].

Planespotters.net. 2025. South African Airways fleet details. [Online] Available at: https://www.planespotters.net/airline/South-African-Airways [accessed: 27 August 2025].

Reuters. 2024. Cathay Pacific to buy back remaining 50% of HK government's preference shares. [Online] Available at: https://www.reuters.com/business/aerospace-defense/cathay-pacific-buy-back-remaining-50-hk-governments-preference-shares-2024-07-05/ [accessed: 27 August 2025].

Sibiya, N. & Cowan, K. 2025. DA wants Public Protector to probe Mashatile, Creecy for interference in SAA CEO selection. [Online] Available at: https://www.news24.com/southafrica/news/da-wants-public-protector-to-probe-mashatile-creecy-for-interference-in-saa-ceo-selection-20250225 [accessed: 27 August 2025].

Sidimba, L. 2025. Mango airline's business rescue plan faces setback as court ruling is challenged. [Online] Available at: https://iol.co.za/news/south-africa/2025-07-17-mango-airlines-business-rescue-plan-faces-setback-as-court-ruling-is-challenged/ [accessed: 27 August 2025].

South African Airways. 2025. Annual Financial Statements, 2023/2024 Audit Financial Statements. [Online] Available at: https://www.flysaa.com/about-us/leading-carrier/media-center/media-releases/newsroom [accessed: 27 August 2025].

Special Investigations Unit. 2025. SIU to investigate the National Skills Fund, Department of Public Works and Infrastructure and expand inquiries into SABC, Eskom, PetroSA, Transnet, SAA, Human Settlements, Alexkor and SACE. [Online] Available at: https://www.siu.org.za/siu-to-investigate-the-national-skills-fund-department-of-public-works-and-infrastructure-and-expand-inquiries-into-sabc-eskom-petrosa-transnet-saa-human-settlements-alexkor-and-sace/ [accessed: 27 August 2025].

Standing Committee on Public Accounts (SCOPA). 2021. SIU Investigation into SAA and DENEL. [Online] Available at: Available: https://pmg.org.za/committee-meeting/32444/ [accessed: 27 August 2025].

Thorne, S. 2024. Parliament calls for probe into collapsed SAA-Takatso deal. [Online] Available at: https://businesstech.co.za/news/government/762161/parliament-calls-for-probe-into-collapsed-saa-takatso-deal/ [accessed: 27 August 2025].

Time. 2019. Welcome to the Restaurant With a Front‑Row Seat at the Hong Kong Protests. Time. [Online] Available at: https://time.com/5693958/hong-kong-protests-restaurant-video/ [accessed: 27 August 2025].

US Department of Transportation. 2025. Alaska-Hawaiian merger agreement. [Online] Available at: https://www.transportation.gov/sites/dot.gov/files/2025-06/Alaska_Hawaiian_merger_agreement.pdf [accessed: 27 August 2025].

Wong, W. 2024a. Hong Kong’s Cathay Pacific to buy back HK$9.7 billion worth of preference shares from government as part of its bailout package. [Online] Available at: https://www.scmp.com/news/hong-kong/transport/article/3269370/hong-kongs-cathay-pacific-buy-back-hk97-billion-worth-preference-shares-government [accessed: 27 August 2025].

Wong, W. 2024b. Hong Kong’s Cathay Pacific should improve service, tap belt and road potential: Paul Chan. [Online] Available at: https://www.scmp.com/news/hong-kong/hong-kong-economy/article/3269485/finance-chief-urges-cathay-pacific-airways-raise-service-quality-boost-hong-kongs-aviation-hub [accessed: 27 August 2025].

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

This report has been published by the Inclusive Society Institute

The Inclusive Society Institute (ISI) is an autonomous and independent institution that functions independently from any other entity. It is founded for the purpose of supporting and further deepening multi-party democracy. The ISI’s work is motivated by its desire to achieve non-racialism, non-sexism, social justice and cohesion, economic development and equality in South Africa, through a value system that embodies the social and national democratic principles associated with a developmental state. It recognises that a well-functioning democracy requires well-functioning political formations that are suitably equipped and capacitated. It further acknowledges that South Africa is inextricably linked to the ever transforming and interdependent global world, which necessitates international and multilateral cooperation. As such, the ISI also seeks to achieve its ideals at a global level through cooperation with like-minded parties and organs of civil society who share its basic values. In South Africa, ISI’s ideological positioning is aligned with that of the current ruling party and others in broader society with similar ideals.

Email: info@inclusivesociety.org.za

Phone: +27 (0) 21 201 1589

SUDIRMAN168 SUDIRMAN168 SUDIRMAN168 LAPAKBET777 TERMINAL4D TERMINAL4D

#MANTAPWD Adalah Situs Resmi Tergacor Dan Terpercaya Di Asia

🔰 𝐋𝐈𝐍𝐊 𝐒𝐈𝐓𝐔𝐒 𝐆𝐀𝐂𝐎𝐑 🔰

╰─➤ LOGIN MANTAPWD

╰─➤ DAFTAR MANTAPWD

╰─➤ LINK MANTAPWD

╰─➤ LINK ALTERNATIF MANTAPWD

╰─➤ SITUS MANTAPWD RESMI

╰─➤ SITUS GACOR MANTAPWD

LAPAKBET777LOGIN

ALTERNATIFLAPAKBET

LAPAKBET777DAFTAR

LAPAKBET777OFFICIALL

LAPAKBET777RESMI

From engaging conversation to intimacy, the experience is guaranteed to be top-class. Their Escorts in Delhi ensures you are in the best of professional, discreet hands while you immerse yourself in the delights of another.

SUDIRMAN168

SUDIRMAN168DAFTAR

SUDIRMAN168LOGIN

SUDIRMAN168ALTERNATIF

SUDIRMAN168MAXWIN

LAPAKBET777

LAPAKBET777DAFTAR

LAPAKBET777LOGIN

LAPAKBET777ALTERNATIF

LAPAKBET777MAXWIN

TERMINAL4D